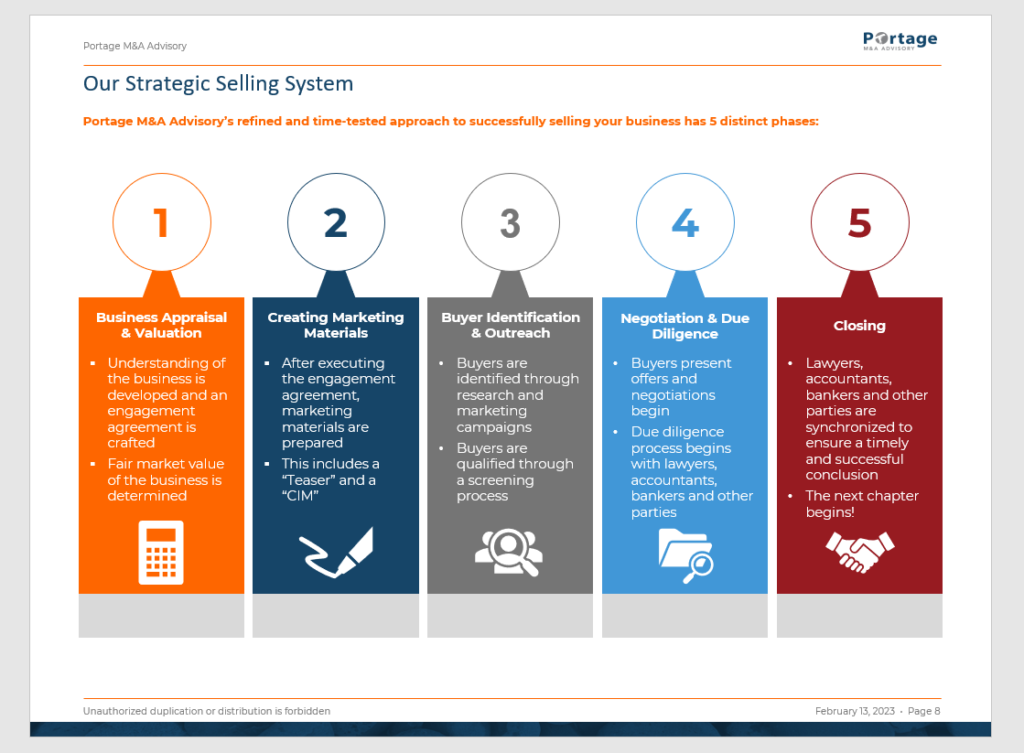

Orchestrating an M&A deal involves several key steps, including valuation, documentation, buyer identification, negotiation, and due diligence. Here is a general outline of how to structure an M&A deal:

- Valuation: This involves determining the value of the target company. Valuation methods may include discounted cash flow analysis, comparable company analysis, or very common to the lower middle market a comparable transaction analysis, among others.

- Documentation: Once the business owner and M&A advisor are aligned on valuation and sale process, an engagement letter will be executed. From there, an information request list details what is required for marketing a deal, and for due diligence on a deal. Marketing materials are prepared, this includes a “Teaser” and a “CIM”.

- Buyer Identification & Outreach: Buyers are identified through internal networks and research. Buyers are qualified through a vetting process.

- Negotiation: Key issues that need to be negotiated include the purchase price, financing arrangements, post-closing obligations, and representations and warranties.

- Due diligence: This is the process of analyzing information about the target company to determine its financial, operational, and legal status. Due diligence is critical to ensure that the buyer is aware of any potential risks and liabilities associated with the acquisition.

- Closing: The closing is the final step in the M&A process, where the buyer and the seller exchange the agreed-upon consideration and the transaction is completed.

It’s important to note that M&A transactions can be complex and involve many legal, financial, and operational considerations. As a result, it is common for both the buyer and the seller to engage the services of professionals, such as lawyers, accountants, and M&A advisors, to assist with the transaction.

Thomas Bevilacqua

Vice President, M&A | Portage M&A Advisory